Metro moves forward with aerial tram to Dodger Stadium

Elon Musk has some serious competition in his plans to get Dodger fans to and from games.

Metro CEO Phil Washington announced Thursday that the agency had signed a letter of intent with a company called Aerial Rapid Transit Technologies that plans to build an aerial tram running between Union Station and the stadium.

The letter will allow the agency to begin negotiations with the company in order to allow the proposal to move forward.

ARTT is led ...

How is Metro going to finish 28 projects in 10 years?

A tax on scooters and tolls for drivers on the road during rush hour are two possible sources of funding that Metro could use to pay for an ambitious plan to complete 28 projects in time for the 2028 Olympics.

The agency’s board of directors will consider a report this week that outlines how the agency could carry out Mayor Eric Garcetti’s “Twenty-eight by ’28” initiative without compromising service or going deep into debt.

Most of the ...

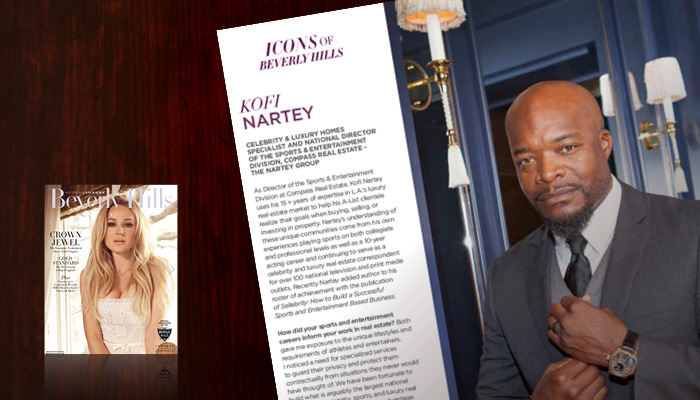

Kofi named an Icon of Beverly Hills

Modern Luxury Beverly Hills – the official publication of the Beverly Hills Chamber of Commerce – has named The Nartey Group's Kofi Nartey an Icon of Beverly Hills, an honor that included a write-up in the Fall/Winter issue of the magazine. Kofi's interview can be found below, and can also be read in the magazine's digital edition.

- - -

Kofi Nartey: Celebrity & luxury homes specialist and National Director of the Sports & Entertainment ...

Hollywood and Highland shopping center reportedly for sale

Ownership of the Hollywood and Highland shopping center could be changing. The Real Deal reports that owner CIM Group and Abu Dhabi Investment Authority have listed the roughly 450,000-square-foot tourist magnet for sale.

Sources tell The Real Deal a sale could bring in as much as $300 million.

Located along the Walk of Fame, Hollywood and Highland stands out, perhaps in large part because of it unusual design, inspired by a Babylonian film set ...

Big Bunker Hill project by Frank Gehry getting underway this month

A highly anticipated apartment, hotel, and shopping complex designed by Frank Gehry atop Bunker Hill takes a big step forward today. Developers for The Grand (formerly the Grand Avenue Project) announced they have secured $630 million in construction financing for the $1 billion project.

Pre-construction work, including demolition on a parking structure on the property, will begin this month on the Grand Avenue site. The property sits just east of ...

Santa Monica ballot measure would require ‘supermajority’ vote for taller, denser buildings

Development battles in Santa Monica have largely fizzled out. Now, two City Councilmembers seeking reelection say they want to end the building wars for good.

A measure on the November 6 ballot would require developers to get the approval of a “supermajority” of the Santa Monica City Council to deviate from the city’s building height and density limits.

If Measure SM passes, for the next 10 years, developers wanting to build taller or denser ...

Tunneling begins on Metro’s subway to the Westside

Tunneling is officially underway on Metro’s Purple Line subway extension to the Westside of Los Angeles.

The first round of tunneling started Tuesday beneath the intersection of Wilshire Boulevard and La Brea Avenue.

Twin 450-foot-long tunnel boring machines (dubbed Elsie and Soyeon) will carve out about 60 feet of tunnel daily for the next two years, en route to the Wilshire/Western station, where Purple Line trains now turn back for Downtown ...

Kofi Nartey accepted into Forbes Real Estate Council

10/11/18 | Beverly Hills, CA - Celebrity & luxury real estate specialist Kofi Nartey has been accepted into Forbes Real Estate Council.

Forbes Real Estate Council is an invitation-only community for executives in real estate.

Kofi and his team – The Nartey Group at Compass – have a long-standing reputation for servicing the real estate needs of celebrity and luxury clientele.

Kofi was vetted and selected by a review committee based on ...

Netflix will lease second office tower under construction now in Hollywood

Netflix is doubling down on Hollywood. Today, developers of EPIC, a 13-story office development on Sunset Boulevard, announced that the streaming company has signed a lease for the entire building.

“EPIC is part of our continuing investment in LA and Hollywood,” Netflix’s chief financial officer David Wells said in a statement. “We’re thrilled to be able to continue to grow our team there.”

EPIC is designed by Gensler, and will feature ...

Google officially moves in to Playa Vista’s Spruce Goose hangar

Two years ago, Google started leasing a massive airplane hangar in Playa Vista. On Tuesday, the tech giant moved in, says Playa Vista’s corporate blog.

In terms of size, the new location is an indisputable upgrade. The Spruce Goose hangar—which once housed Howard Hughes’s Hughes H-4 Hercules—is three times the size of the company’s Frank Gehry-designed offices in Venice, where Google has held offices since 2011.

The move to Playa Vista ...